Executive Summary

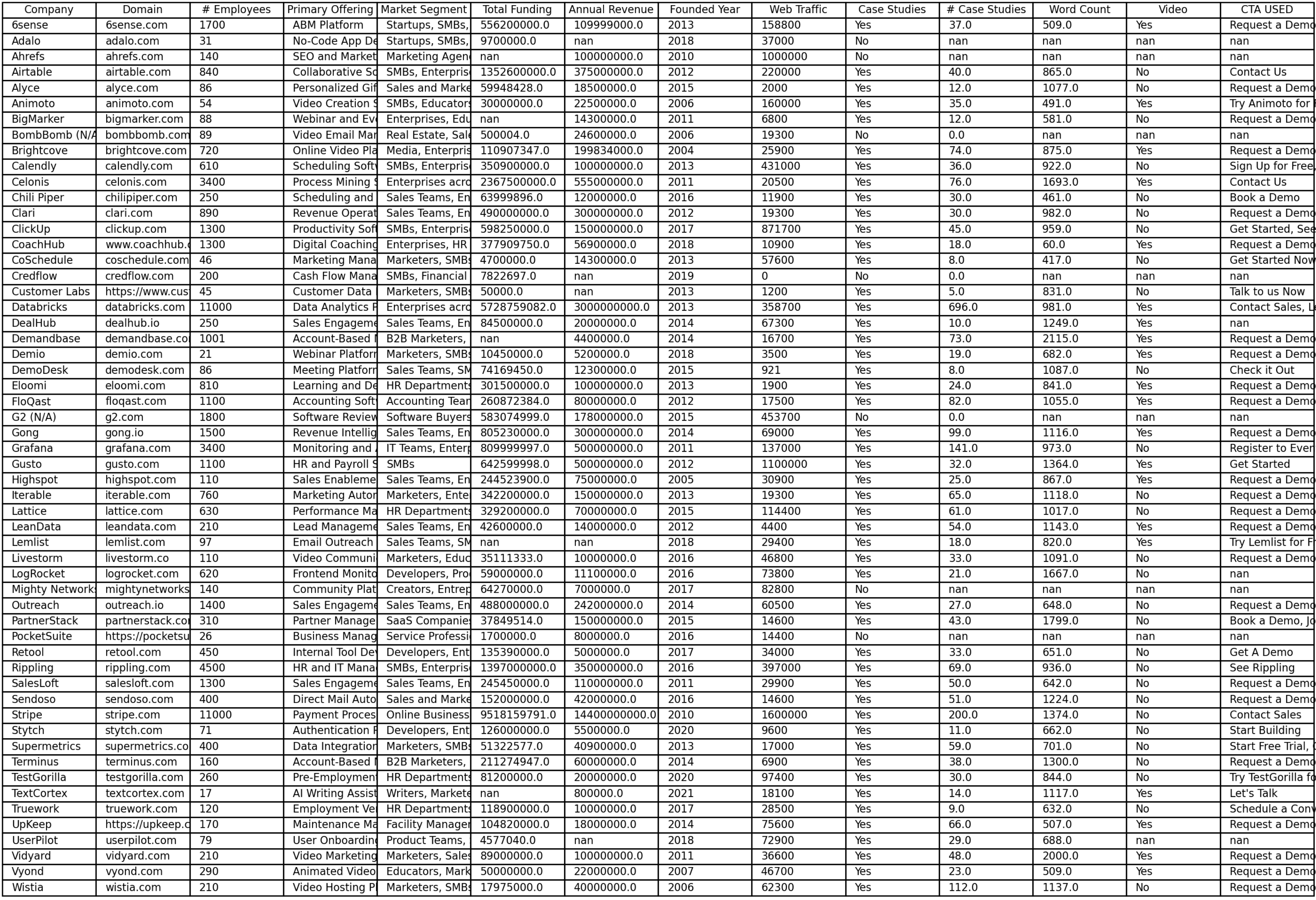

We've carefully analyzed 58 of the fastest-growing SaaS companies from 2024 to assess how they incorporate social proof on their websites, what best practices they share, and how you can align your content strategy with their tactics.

We chose "fastest-growing" because this report is intended to find trends in social proof strategies that can help marketers increase the type of marketing conversions that accelerate growth.

- 88% of companies leverage case studies, with an average of 45 case studies per website.

- 96% feature logos within the Hero Section of their homepage.

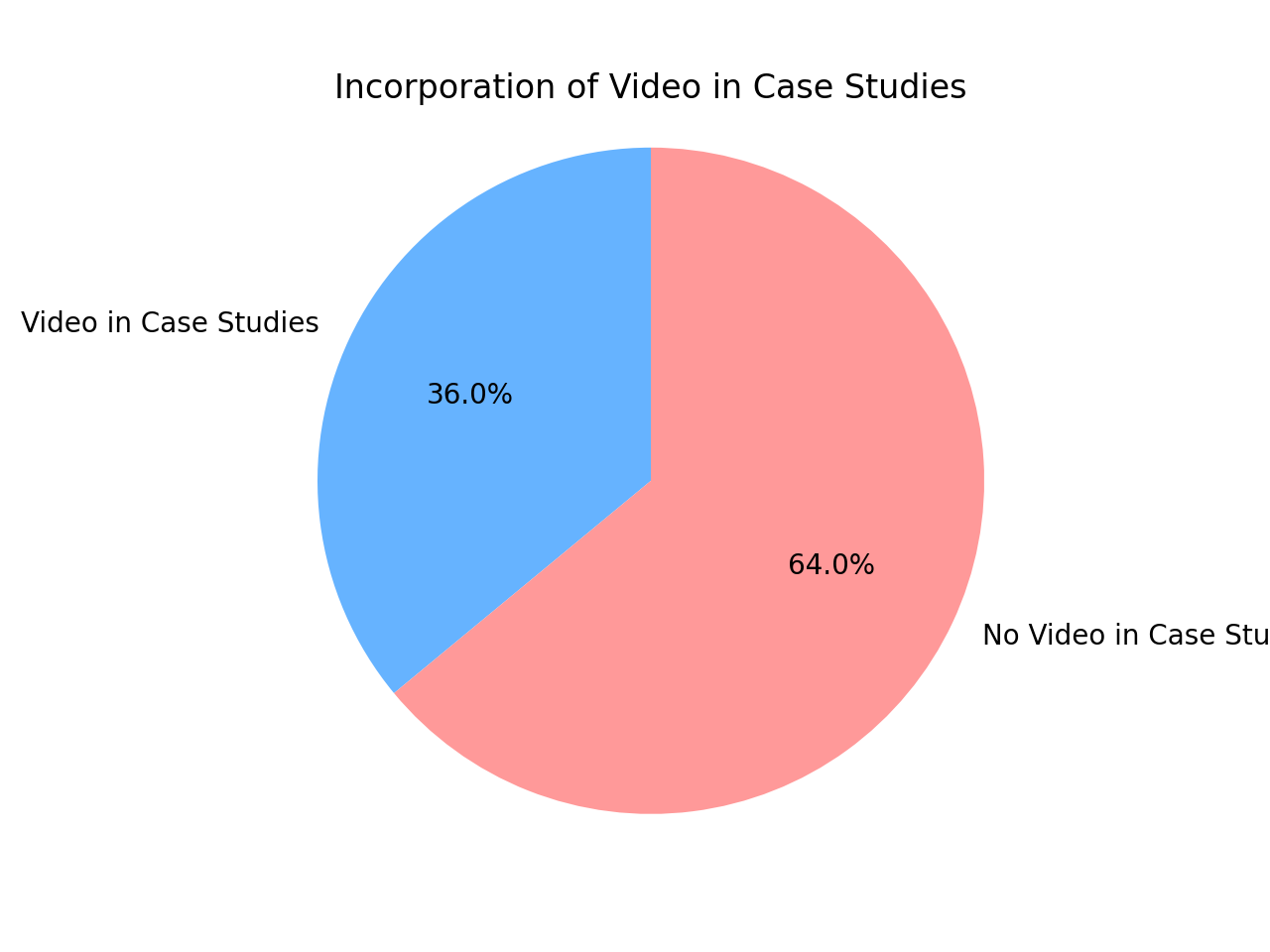

- 36% incorporate video directly within their case studies.

- Strong correlation between case studies and web traffic for sub-30,000 traffic companies.

How We Made This Report

Each company's website was visited and analyzed for social proof elements. AI-assisted tools were leveraged where possible, but our team also conducted manual reviews to identify trends, tactics, and strategies. We also examined a subset of case study pages to evaluate formatting, word count, and video inclusion.

Additionally, we cross-referenced this data with company information, including founding year, marketing team size, industry, revenue, and funding amount.

Who's In This Report?

This report focuses on growing B2B SaaS startups, primarily targeting enterprise customers with both self-install and full sales cycle evaluation processes. According to Exploding Topics, this list includes reputable brands such as Gong.io, Databricks, Outreach, and more.

The top growing SaaS companies were sourced from:

- Exploding Topics B2B SaaS Startups

- Datamation SaaS Companies

Who's This Report For?

This report is designed for B2B SaaS and technology GTM leaders, including CEOs, Heads of Marketing, Heads of Sales, and marketing professionals. In a highly competitive landscape where mature marketing organizations deploy significant resources to content creation, this report distills best practices for leveraging social proof on your website to improve visitor experience and drive lead conversion.

Initial Overview

88% of the companies in this report leverage case studies. Among them, the average number of case studies per website is 45. This excludes the notable outlier Databricks, which has 696 case studies! We'll dive more into their specific situation later.

Common Characteristics of Companies Using Case Studies

Of the 88% of companies prioritizing case studies for their social proof content, we observed the following trends:

- Primarily B2B software solutions targeting mid-market and enterprise

- Customer success as a key business function

- Multi-buying committee sales process

Common Characteristics of Companies Without Case Studies

- Primarily individual buyer solutions

- Lower contract values

- More self-serve/trials-based onboarding

Some examples include companies like Adalo, which primarily sells to freelancers and startups, or Pocketsuite, which targets independent service businesses such as trainers and hairstylists. In these instances, reviews from individual consumers are prioritized for social proof instead of case studies.

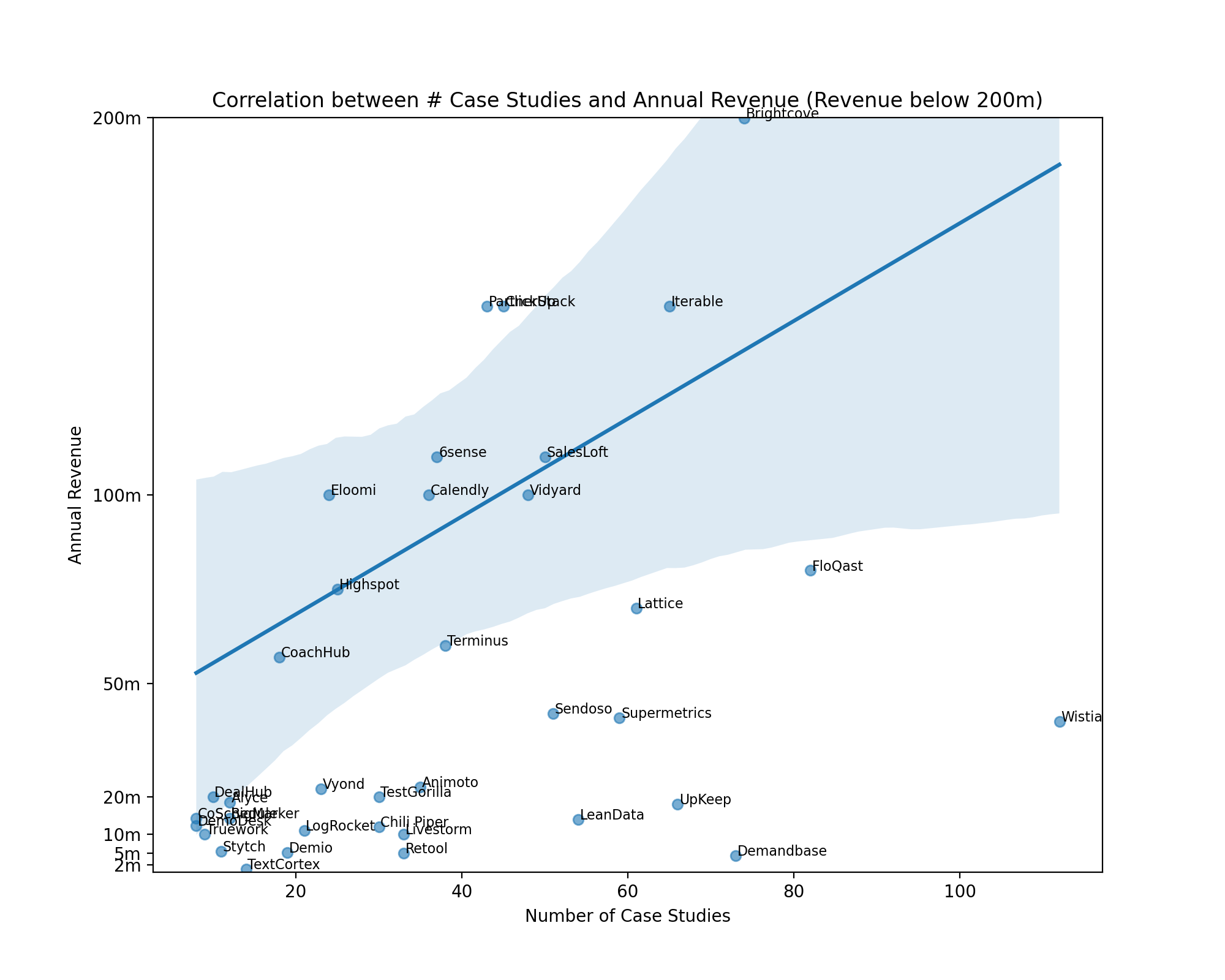

Case Studies and Their Correlation with Revenue

We analyzed the correlation between the amount of case studies and company revenues.

Based on the chart, among companies with annual revenue under $200M, there is a moderate positive correlation between the number of case studies and annual revenue. This suggests that, generally, companies that showcase more case studies tend to have higher revenue—even within the sub-$200M ARR group.

However, the trend is moderate, indicating that while more case studies might be associated with higher revenue, other factors also likely influence these outcomes.

- For companies below $20M ARR: Average of 27 case studies

- For companies above $20M ARR: Average of 55 case studies

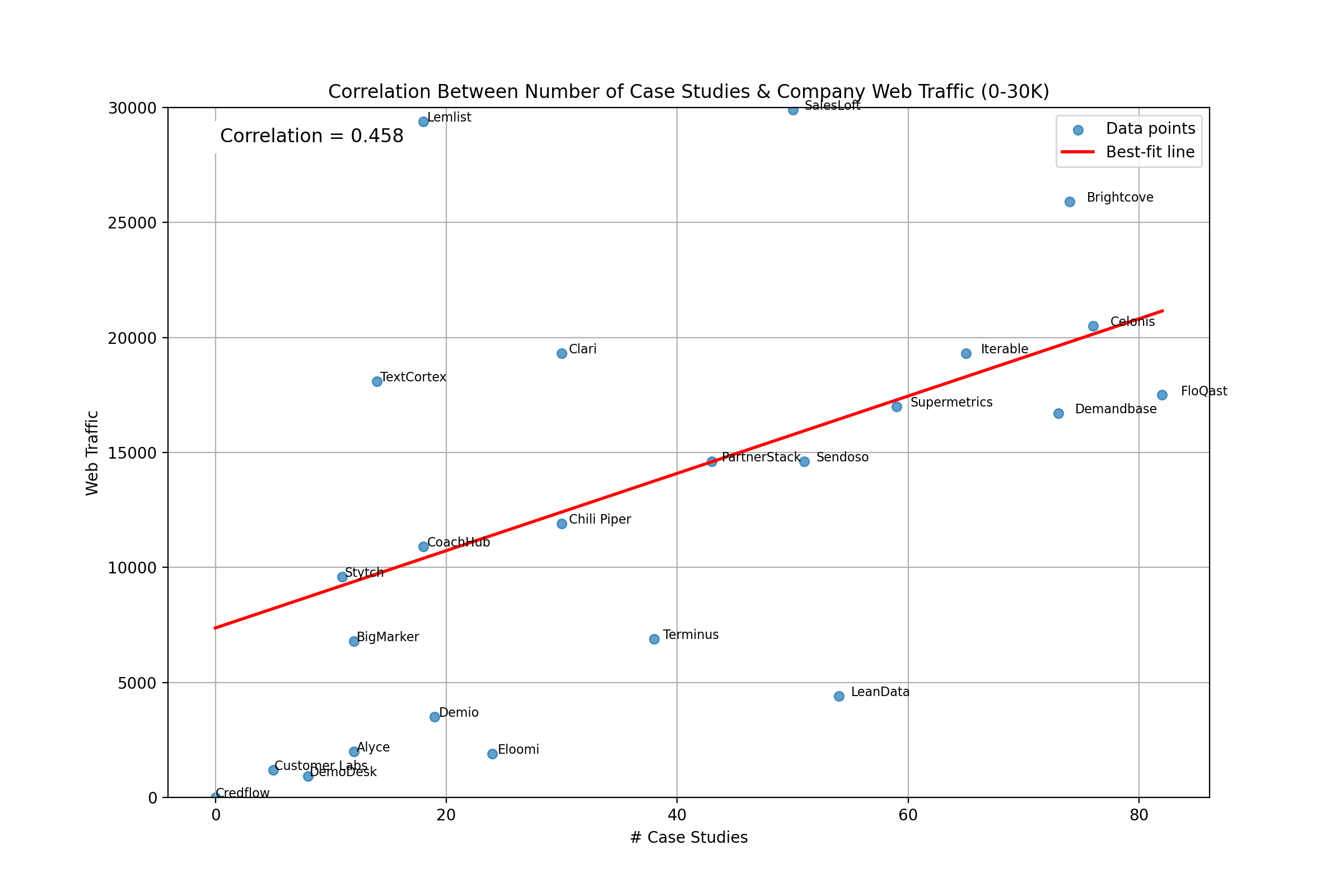

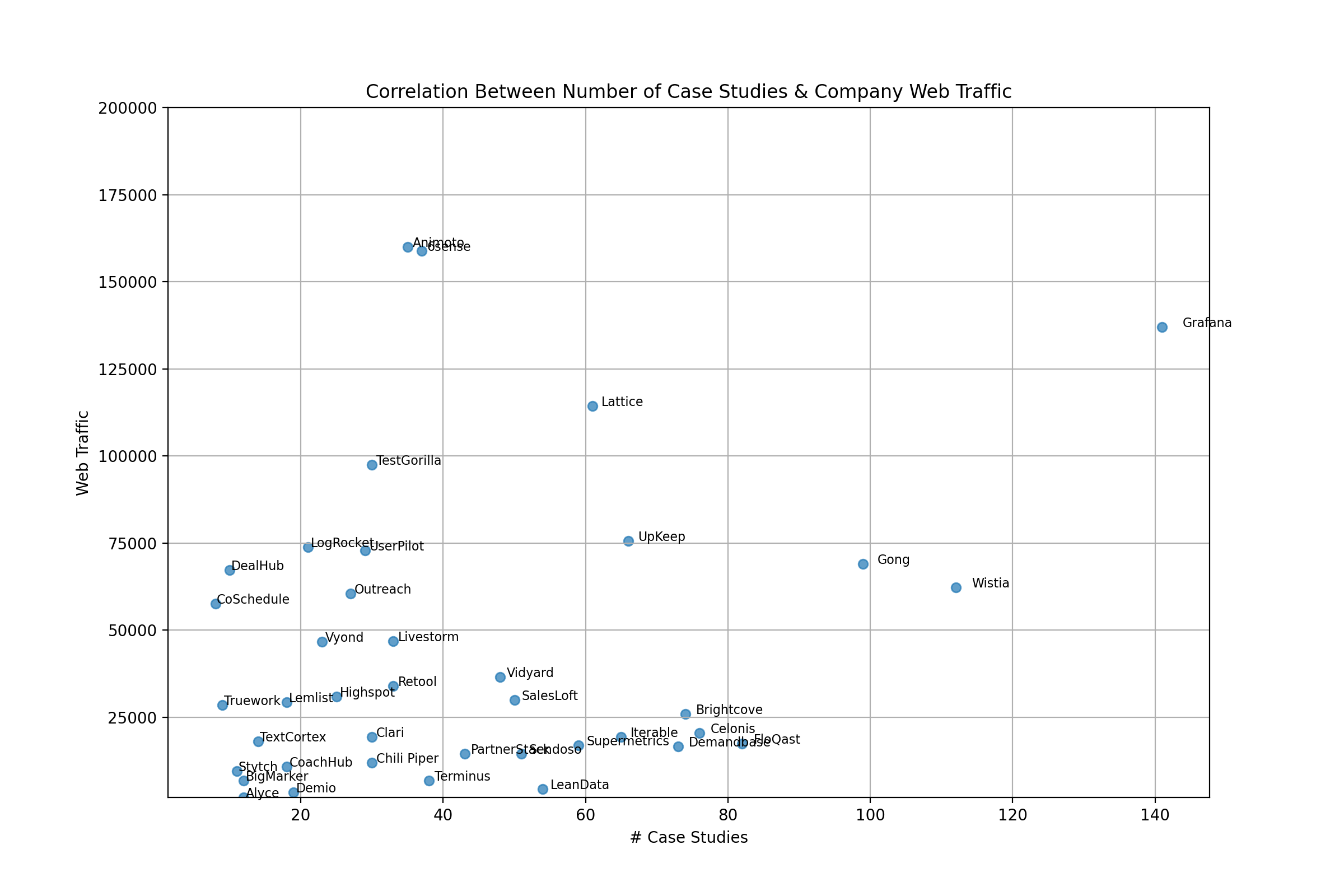

Case Studies and Their Correlation with Web Traffic

In an effort to assess the importance of case studies, we also analyzed if there are any trends with the amount of case studies and accompanying web traffic. This data was cross-referenced with traffic figures from Semrush.

Upon first glance, analyzing case study figures correlated to web traffic, there isn't much of a conclusion to be drawn.

The reason for this analysis is to assess if case studies become less pertinent the more your brand builds brand awareness. You could deduce that getting more case studies has diminishing returns once you've achieved a certain level of brand awareness when observing these figures.

What's more interesting however is narrowing into the companies plotted within the sub-30,000 web traffic range.

This is where the data becomes very interesting.

For sub-30,000 web traffic companies, suddenly, there's an incredibly strong correlation between case studies and web traffic.

So then the question might be: What came first?

Considering that majority of web traffic is driven by SEO, targeting awareness stage key terms, we would estimate that web traffic came first, and as company solutions evolve, different buyers evaluate, use cases expand—then more case studies were prioritized to better convert this web traffic.

Either way, the correlation is compelling in the fact that case studies are essential in supplementing your web presence as you start to acquire more visitors to the site.

Home Page Insights

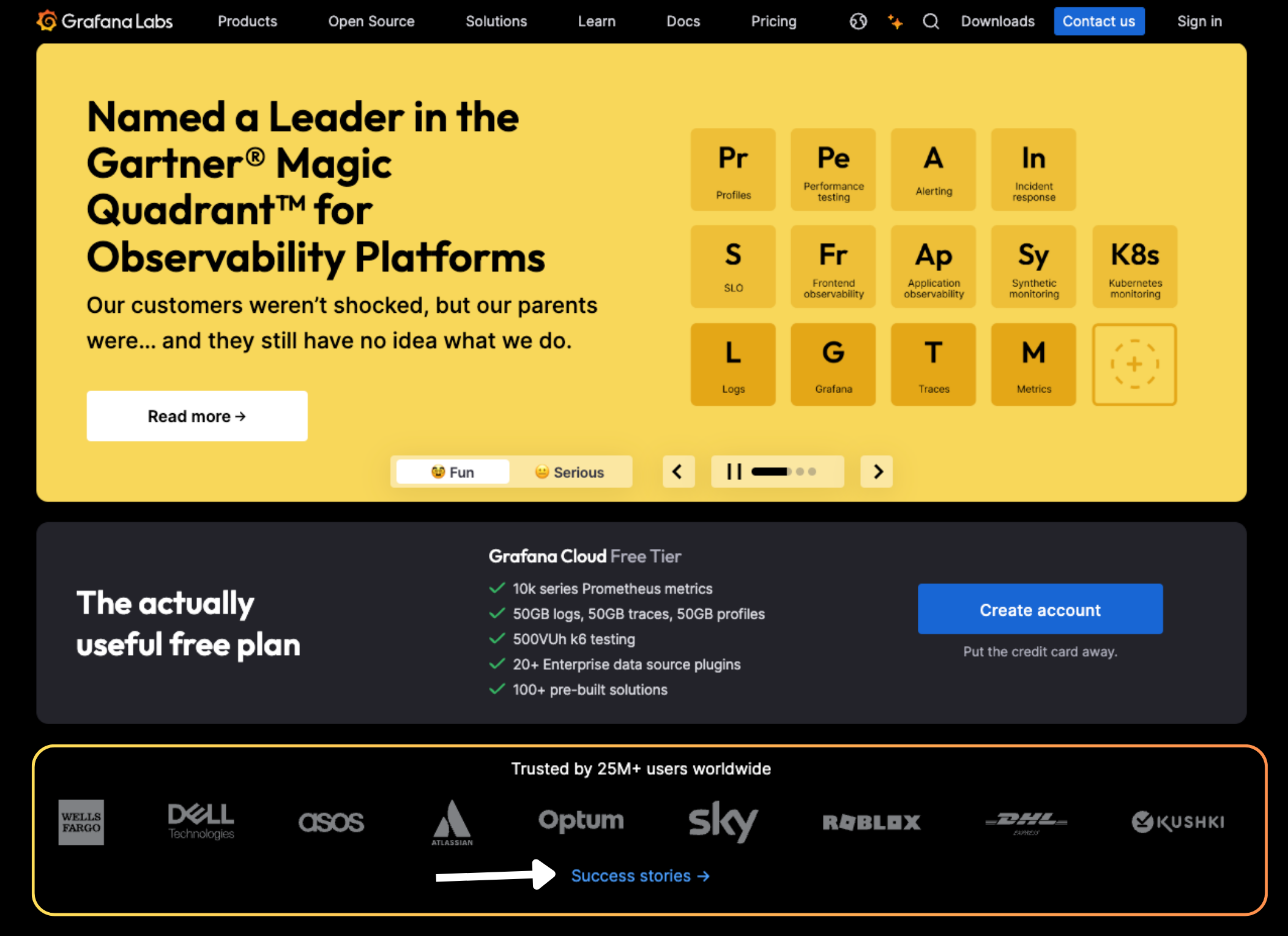

Since the homepage is the most visited entry point for potential customers in the consideration stage, top SaaS companies integrate social proof prominently:

- 96% of companies feature logos within the Hero Section of the homepage. This is essential in establishing social proof upfront.

- Anecdotally we noticed a handful of companies even linked to success stories immediately within the hero section as well.

Weaving Social Proof Across the Home Page

Companies varied the formatting they used to weave social proof into their home pages. Notably, the most effective examples were those that integrated social proof naturally, aligning with the primary value propositions typically presented on a home page.

Deep Dive: Gong.io's Social Proof Tactic

Instead of only listing product features, Gong.io integrates customer outcomes alongside its solution areas:

- Example Claim: "X% increase in pipeline conversion."

- This is backed by a customer story instead of a generic marketing claim.

- Enhances credibility with real customer outcomes.

- Allows for cherry-picking the best results to market the product effectively.

- Works well for growing SaaS companies that may lack large-scale statistics but have compelling individual success stories.

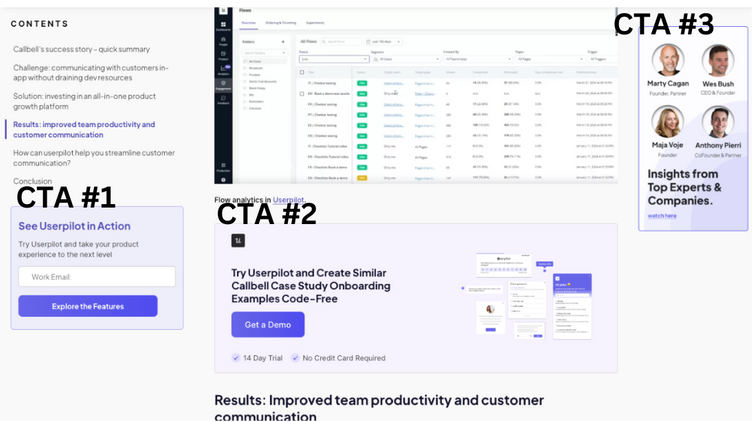

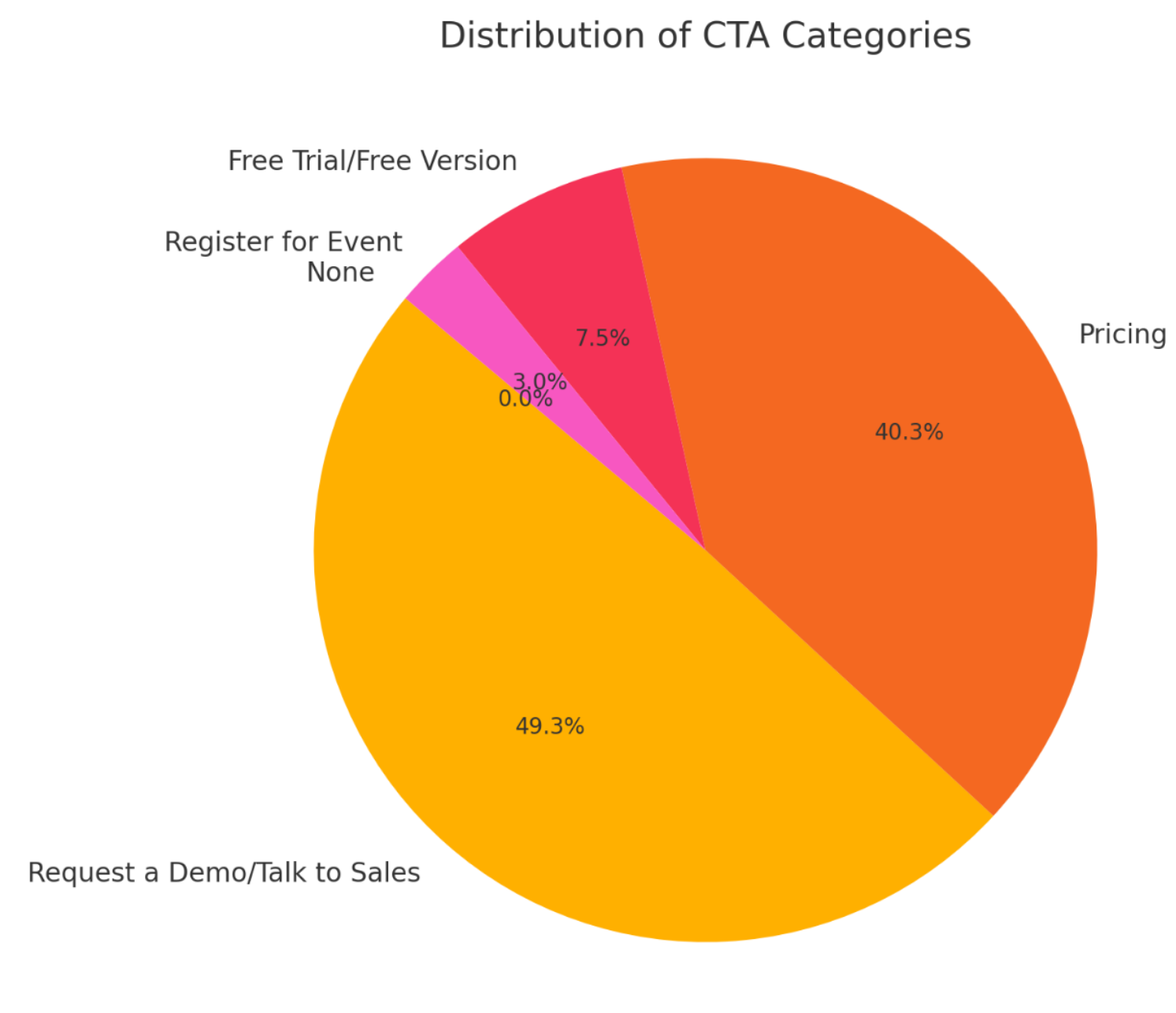

Case Study CTAs

Social proof is an essential subset of effective landing pages, designed to convert leads. So it's no surprise that case study pages are also pivotal avenues of lead conversion in themselves. It's worth noting that case studies on your website typically represent a solution-aware buyer.

Therefore CTAs at this stage are typically designed to convert to leads or free trials.

- UserPilot — SaaS Landing Pages Best Practices

Case Study Length and Audience

The average word count for customer stories is 965 words.

The length of a case study appears highly dependent on the target audience and the various buyer perspectives expected to review it. For example:

- Coachhub prioritizes video over written content, resulting in shorter text for their case studies.

- Demandbase frequently exceeds 2,000 words, embedding multi-stakeholder perspectives throughout their articles.

This variation highlights the crucial role of formatting. Executives typically prefer concise summaries with key takeaways, while technical teams value in-depth detail.

If the likely audience is known, you can tailor the case study length accordingly (shorter or longer). However, if the audience is anticipated to be both executives and technical users, a valuable approach, similar to Demandbase's, is to balance these elements. By doing so, businesses can create impactful case studies that drive engagement and decision-making.

- Proofmap — How to Write a SaaS Case Study That Converts

Writing Style & Storytelling

In reviewing a subset of the case studies by the top growing companies, we observed these common trends when it comes to writing style:

- Conversational Yet Professional: The tone is typically engaging, avoiding excessive technical jargon while remaining professional.

- Customer-Centric Narrative: Instead of focusing on the vendor, the emphasis is placed on the customer's journey and transformation.

- Storytelling Approach: A strong narrative is maintained, treating the case study like a mini success story rather than a dry business report.

- Use of Emotion & Personality: Some case studies incorporate humor, enthusiasm, or an emotional appeal to make the content more relatable.

Story Telling Trends

93% of the case studies we reviewed utilized a form of the Challenge-Solution-Impact Model. This is a story arc that has proven to be effective:

- The Problem: Highlighting a pain point or inefficiency.

- The Search for a Solution: Explaining why the company explored alternative solutions.

- The Implementation & Success: Describing how the product was adopted and the results it drove.

- Hero's Journey Angle: Many frame the customer as the hero of the story, with the SaaS product serving as the tool that helps them overcome obstacles.

Metrics & Performance Indicators

Generally speaking, improvement metrics have become ubiquitous but essential in all case studies.

Clear, Quantifiable Results

The best case studies include strong performance metrics. Common ones include:

- Revenue growth (e.g., "Increased revenue by 40%")

- Time savings (e.g., "Cut onboarding time in half")

- Cost reduction (e.g., "Reduced operational costs by 30%")

- Efficiency gains (e.g., "Improved lead conversion rates by 5X")

- Customer engagement improvements (e.g., "Email open rates increased by 70%")

- Pipeline & Deal Closure (e.g., "Deals closed 20% faster")

Before & After Comparisons

Many highlight pre-implementation struggles and post-implementation benefits side-by-side.

Industry Benchmarking

Some compare improvements to industry standards, making results more impactful.

Competitor Differentiation

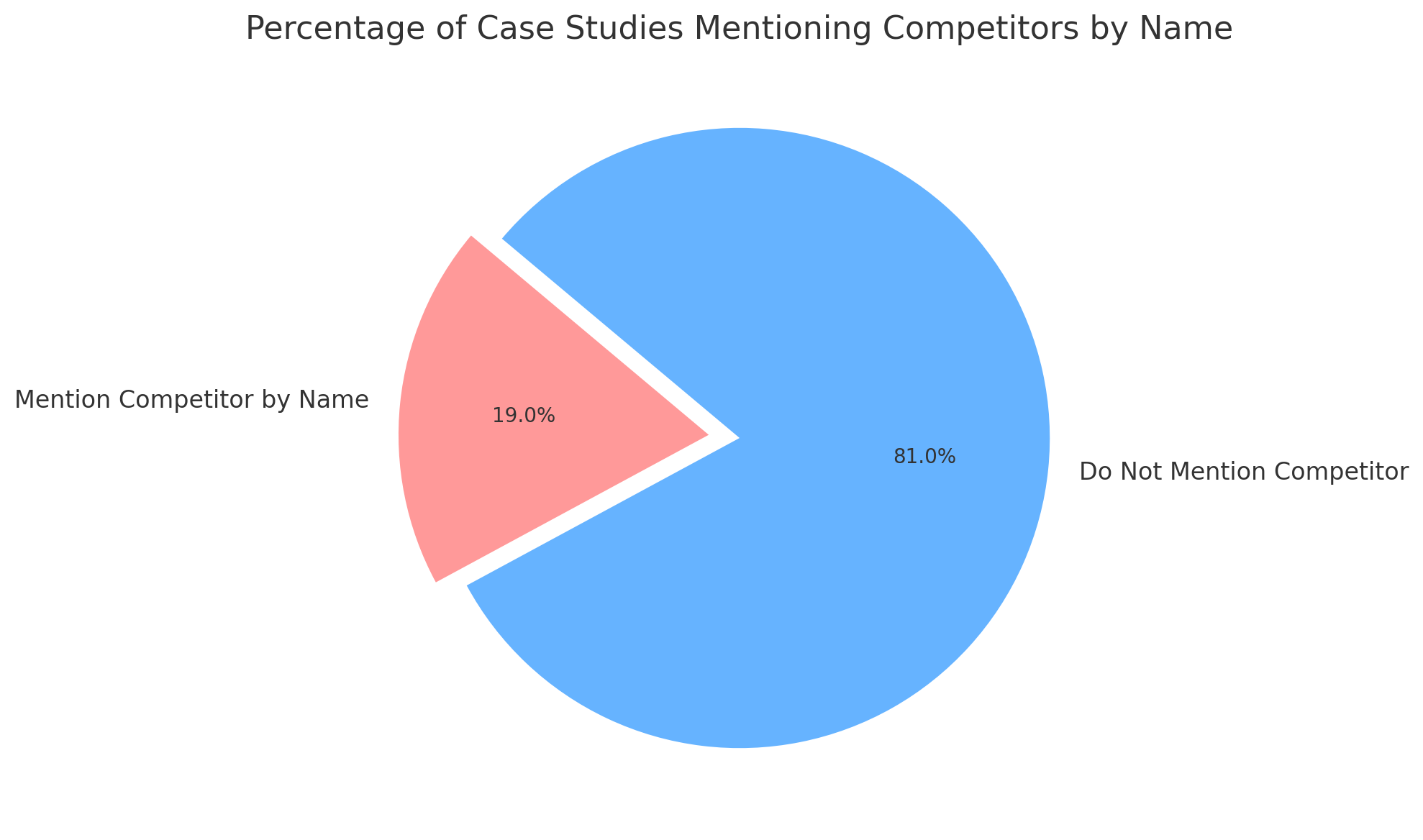

A few subtly compare against competitors but focus more on their unique approach rather than directly attacking rivals. In fact, only 19% of the case studies we analyzed mention their competitors by name in their success stories. Some examples included:

- Demio & Nutshell: "Demio's engagement features outperformed Zoom and GoToMeeting."

- Rippling & Superhuman: "Rippling provided automation that outperformed Gusto for HR processes."

- Gusto & Rise Marketing: "Gusto automated compliance and contractor payments better than PayPal and Payoneer."

From an interview perspective, we recommend treading lightly when it comes to seeking out differentiation with past products or competitors, as it could damage the reputation of the interviewee. However, if customers are willing to state comparisons, then working them in a thoughtful manner can be highly effective in differentiating against competitors, particularly if you're certain that they will be considered in any formal enterprise evaluation alongside your solution.

Common SaaS Themes

Here are the most common themes we saw highlighted across the case studies:

- Automation & Efficiency: Almost every case study emphasizes how the product streamlined workflows, reduced manual tasks, or optimized operations.

- Integration with Other Tools: Many highlight how seamlessly the SaaS solution integrates with other platforms (e.g., CRM, marketing automation, data analytics).

- Scalability & Growth: There's a frequent mention of how the solution enables businesses to scale operations, onboard more customers, or expand globally.

- Personalization & Customer Experience: Some focus on how AI-driven personalization, better targeting, or improved customer engagement has led to better outcomes.

- Data-Driven Decision Making: Many emphasize how better analytics, predictive modeling, or real-time insights improved business outcomes.

Case Study Page Best Practices

Segmentation by Industry

For enterprise-focused SaaS brands, case study segmentation by industry is a best practice. Examples include:

- Sendoso's industry-specific success stories

- Retool's filtering for industry relevance

Where to Feature Case Studies on the Website

Companies integrate case studies across multiple touchpoints:

- With Product Features (e.g., Gong.io)

- On Review Sites

- Blog Page or Separate Page (Demio)

- Customer Statistics Section (Livestorm)

- Highlight Videos (WebinarJam)

- Guest Blogs Featuring Customer Success (Userpilot)

Weaving Social Proof Throughout the Website

Companies like Retool effectively integrate social proof across the entire website, ensuring customers encounter trust signals at every stage of the journey.

Video Integration

36% of companies incorporate video directly within their case studies.

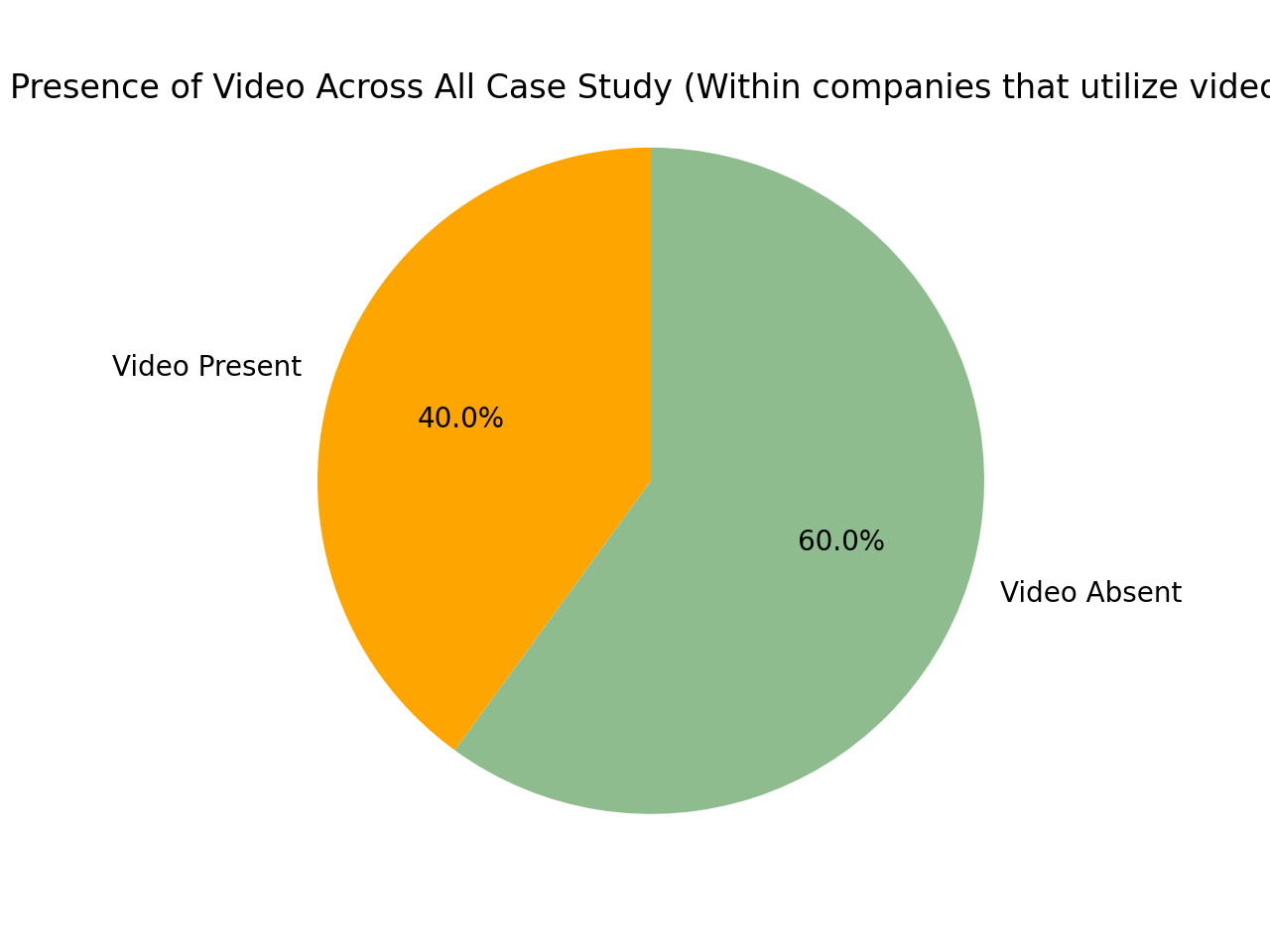

Among them, video is present in roughly 40% of all case studies in their catalog.

One could conclude that this diminishes the necessity for video, but upon further review, when companies did, in fact, leverage video within some of their case studies, and they also segmented case studies by "featured case studies," they were more than 90% of the time included within featured case studies.

This would conclude that the lack of video coverage across case studies is more an acquisition challenge than a preference.

Why Video is Important

Written case studies build trust, but without video testimonials, readers may question their credibility. Video testimonials eliminate doubt by providing a transparent, first-hand account.

- Testimonial videos on sales pages increase conversions by 80%.

- 72% of customers trust a brand more after watching positive video testimonials.

- Websites with video content are 53x more likely to appear on Google's first page.

- Viewers retain 95% of a video message versus 10% when reading text.

- 66% of customers find short-form video the most engaging content type on social media.

- 88% of customers trust video content as much as personal recommendations.

- 72% prefer video for learning about products or services.

Consumers are increasingly accustomed to video content. As younger professionals assume more buying roles, this preference will only grow.

Key Takeaways

- Case studies are essential: 88% of top SaaS companies use them, with strong correlation to revenue and web traffic.

- Navigation matters: Make case studies accessible within 1-2 clicks from homepage.

- Homepage social proof: 96% feature logos in the hero section—this is table stakes.

- Storytelling wins: 93% use the Challenge-Solution-Impact model.

- Video is underutilized: Only 36% include video, but it appears in 90%+ of "featured" case studies—an acquisition challenge, not a preference issue.

- Competitor mentions are rare: Only 19% name competitors directly—tread carefully but strategically.

- Average word count: 965 words, but tailor to your audience.

Use customer proof when describing solution areas to increase credibility and engagement. The companies that systematically integrate social proof across their entire web presence—not just on a dedicated "customers" page—are the ones seeing the strongest results.