Executive Summary

The macroeconomic environment for B2B SaaS and enterprise technology has shifted from “growth at all costs” to “efficient, durable growth.” Traditional acquisition levers—paid media, cold outreach, and volume-based lead gen—are experiencing diminishing returns while buyers increasingly demand peer validation.

This report frames Customer Advocacy Programs (CAPs) as capital-efficiency engines: they reduce acquisition costs, increase net revenue retention, and lower cost-to-serve through community-driven support deflection.

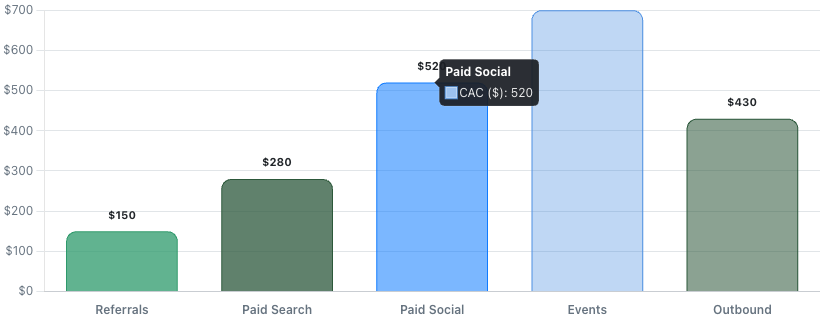

- Acquisition Efficiency: Referral channels benchmark at ~$150 CAC vs. $280–$700+ for paid channels.

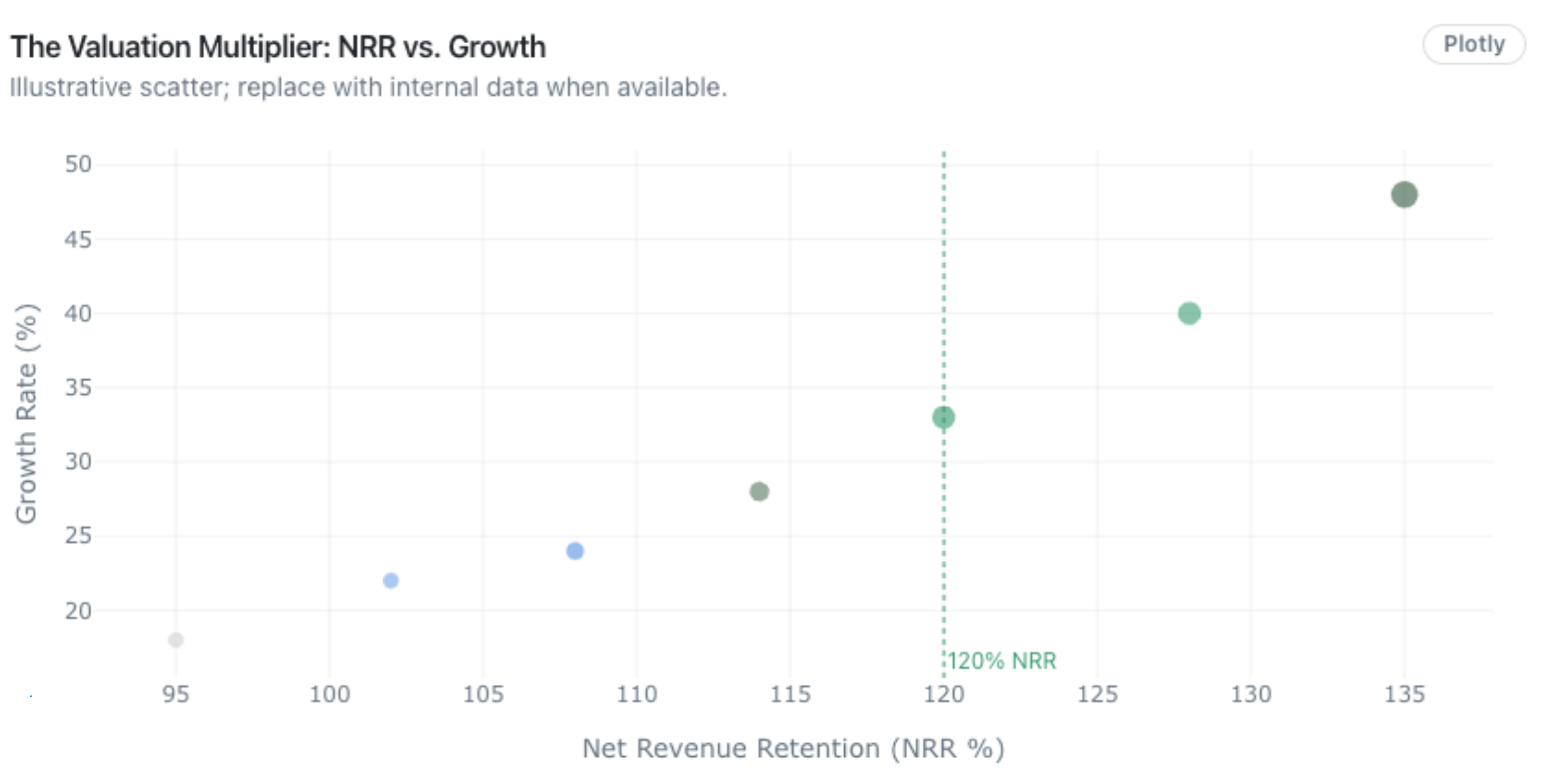

- Retention Economics: High advocacy correlates with 120%+ net revenue retention and stronger valuation multiples.

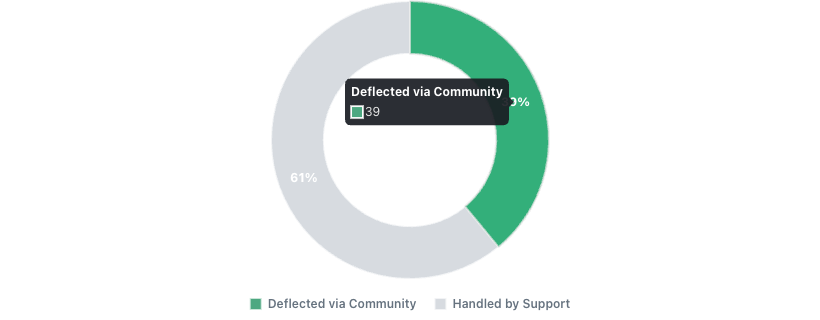

- Operational Savings: Communities can deflect ~39% of tickets, reducing support OpEx.

- Trust Arbitrage: Advocacy bypasses the Trust Gap; buyers consistently trust peers over vendor claims.

1. The Macro-Strategic Context

In 2025–2026, boards and investors scrutinize unit economics: CAC payback, burn multiple, and net retention carry more weight than raw volume. Top performers grow faster by compounding organic and advocacy-led motions.

2. Quantitative Acquisition Data & Benchmarks

The most direct financial impact of advocacy appears in acquisition: proof assets and customer references improve conversion rates, sales velocity, and blended CAC.

Win Rate & Funnel Efficiency Delta

Opportunities that leverage customer references often see meaningful win-rate uplift. Below is a compact benchmark comparison you can customize to your internal metrics.

| Metric | Industry Benchmark | Advocacy Benchmark | Efficiency Delta |

|---|---|---|---|

| Visitor-to-Lead | ~1.4% – 1.9% | ~2.9% | +50–100% Lift |

| MQL-to-SQL | ~15% – 21% | ~39% – 50%+ | ~2× Higher |

| Win Rate | ~20% – 30% | 36% – 50% | +20–50% Uplift |

| CAC | $280 – $728+ | ~$150 | ~4.8× Efficiency |

3. Lifetime Value (LTV) & Retention Economics

Retention drives enterprise value. Advocacy compounds long-tail revenue by improving product adoption, reducing churn risk, and accelerating expansion.

4. Operational Cost Savings

Advocacy-driven communities and peer-to-peer support can deflect a meaningful portion of support volume—reducing cost-to-serve while improving customer experience.

5. The ROI Formula for Customer Advocacy

To quantify the total economic impact, aggregate three value streams—acquisition lift, retention/expansion lift, and operational cost savings—net of program cost.

ROI Benchmarks

- Influitive: 355% ROI over three years; payback < 6 months.

- UserTesting (Forrester): 415% ROI over three years.

- Cisco (Gateway): $5.4M estimated ROI value.

- Influitive (ROI Study) — Forrester Report

- UserTesting — Unlock Exceptional ROI

- B2B Marketing (Cisco Case Study) — Learn How Cisco Hit an ROI of $5.4 Million

- ChampionHQ — Measure ROI Customer Advocacy

6. Strategic Case Studies & Competitive Benchmarking

6.1 Cisco: The “Gateway” to Advocacy at Scale

- Financial impact: $5.4M estimated ROI value.

- Engagement: 60% advocate engagement rate.

- Content output: 969 product reviews and 27,000+ social shares.

6.2 Alteryx: Unifying Data for Advocacy

- Reviews: 286% YoY increase in customer review volume.

- Revenue influence: Credited with helping secure a $10M deal.

6.3 Zoomin: Deflection as a Cost Strategy

- Deflection: 39% case deflection rate.

- Self-service: 82% self-service rate for technical issues (reported).

- B2B Marketing — Cisco Case Study

- G2 — Alteryx Case Study

- Base.ai — Alteryx Customer Story

- Zoomin — Case Deflection Study (Self-Service)

7. Critical Risks and Mitigation Strategies

7.1 The “Generic Experience” Trap

Programs fail when they treat advocates as a monolithic resource. Hyper-personalize, segment by persona, and maintain an explicit ask/get ratio so advocates receive value for every request.

7.2 Attribution & Measurement Gaps

If ROI cannot be demonstrated, programs are cut. Mitigate via strict CRM logging for reference usage, opportunity tags for “advocacy influenced,” and tracking win-rate deltas.

7.3 Operational Silos

Advocacy benefits accrue across Sales, Customer Success, and Support; align stakeholders via an advocacy council and shared OKRs.

- Relationship One — Top 7 Reasons Advocacy Programs Fail

- SparkCo — Design Customer Reference Program

8. Strategic Recommendations & Roadmap

Treat advocacy as infrastructure—an always-on trust layer that improves every go-to-market motion. Operational deflection builds the foundation, sales activation increases efficiency, and earned growth compounds outcomes.

Phased Implementation

- Phase 1: Foundation & Deflection (Months 1–6) — Launch community + knowledge base. Recruit super users.

- Phase 2: Activation & Acquisition (Months 6–12) — Formalize references and reviews; integrate CRM tracking.

- Phase 3: Expansion & Earned Growth (Year 2+) — Launch referrals + champion tracks; measure earned growth rate.

- ChampionHQ — Measure ROI Customer Advocacy

- Forrester — Earned Growth Metric

- Edelman — Trust Barometer 2026

Sources

References are formatted as Company — Website Page Title, with the page title hyperlinked.

| Company | Website Page Title |

|---|---|

| Phoenix Strategy Group | CAC Benchmarks by Channel 2025 |

| First Page Sage | SaaS Benchmarks Report |

| SparkCo | Design Customer Reference Program |

| GetMonetizely | Net Revenue Retention: The Critical Metric |

| SaaS Capital | Private SaaS Company Growth Rate Benchmarks |

| Gainsight | The New ROI of Community |

| McKinsey & Company | The Net Revenue Retention Advantage |

| Forrester | Earned Growth Metric |

| Edelman | 2026 Trust Barometer |

| Maxio | 2025 SaaS Benchmarks Report |

| Lighter Capital | 2025 B2B SaaS Startup Benchmarks |

| Pavilion | B2B SaaS Performance Benchmarks |

| ChartMogul | SaaS Insights |

| Growth Spree | Is B2B Ads Getting Expensive? |

| Sopro | 55 Sales Statistics and Industry Trends |

| TaMonroe | How to Reduce SaaS Marketing CAC |

| ChurnZero | SaaS Customer Retention Benchmarks |

| ChampionHQ | Measure ROI Customer Advocacy |

| LiveChatAI | Customer Support Cost Benchmarks |

| Influitive | Total Economic Impact of Advocacy |

| UserTesting | Unlock Exceptional ROI |